When an employee has a change in their employing entity, such as when a business is on-sold, it can be difficult to understand what happens to an employee’s existing employment entitlements. This article aims to summarise how these entitlements are treated when a transfer of a business occurs.

Definition of a transfer of business

First, we must establish when a transfer of business occurs to determine who would be classified as a transferring employee. Under Section 311 of the Fair Work Act 2009, a transfer of business is when all of the following happen:

- an employee begins working for the new employer within 3 months of ending their job with a previous employer;

- the employee’s duties are the same or nearly the same as they were for the previous employer;

- there is a ‘connection’ between the previous and new employer.

The meaning of ‘connection’ between the previous employer and the new employer is far broader than simply when the new employer purchases the business of the previous employer. It also can include situations where:

- the previous employer sells some or all of the business’s assets to the new employer (e.g. machinery),

- the employers are ‘associated entities’, as defined under Section 50AAA of the Corporations Act 2001,

- the previous employer outsources the work the employee does to the new employer, or

- the new employer stops outsourcing work to the previous employer.

Impact on the Previous Employer

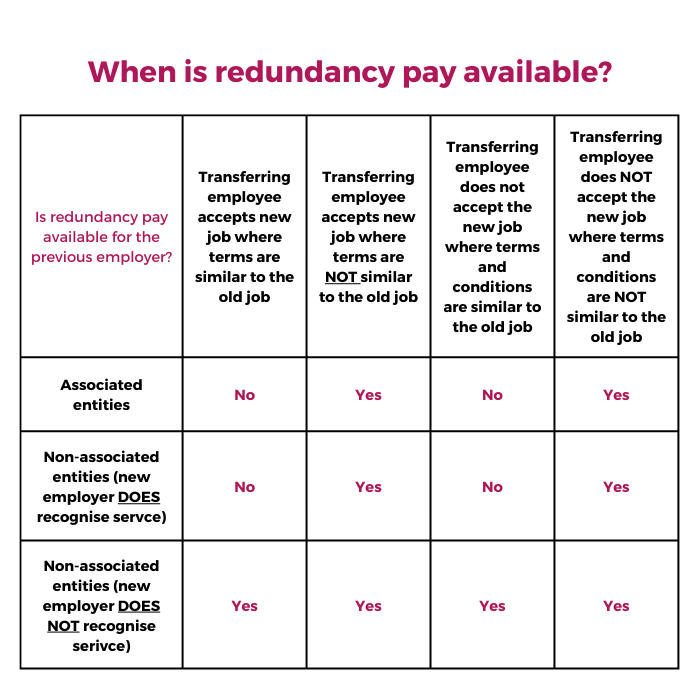

When a transfer of business occurs, there can be some circumstances where redundancy pay will be applicable for the previous employer selling or otherwise transferring the business to the new employer.

It will be payable if the job being offered by the new employer does not have similar terms and conditions to the old job (no less favourable than the previous job), or if the new employer decides not to recognise the employee’s service for redundancy entitlements (only applicable for non-associated entities, see Section 122 of the Fair Work Act 2009 for further information).

Below is a table outlining when redundancy pay would be applicable for the previous employer. Please note that if redundancy pay is applicable, the same rules apply to determine which employees do not receive redundancy pay (click here for further information).

Based on the case Aisle 4 Pty Ltd T/A Greener Grocer v Nicola Hawkins [2021] FWC 4185, the following are relevant factors in determining whether the new job being offered is acceptable:

– Rates of pay | – Fringe benefits | – Accrual of service |

– Hours of work | – Workload | – Probationary periods |

– Work location | – Job security | – Carer’s responsibilities |

– Seniority | – Continuity of service | – Family circumstances. |

Annual leave – when a transfer of business occurs between non-associated entities, the new employer may decide not to recognise an employee’s service with the previous employer for the purposes of annual leave accrual. If this happens, the previous employer will also have to pay out the transferring employee’s accrued annual leave. However, in most cases, this does not occur and the annual leave that accumulated with the previous employer can be carried across to the new employer.

Notice – furthermore, the previous employer must also provide the minimum notice period to transferring employees, as their job with the previous employer is being terminated. If the transfer of business happens before the notice period ends, then the previous employer must still pay the rest of the notice period. As with a regular termination, the previous employer should provide their employees with a written notice of termination.

Impact on the New Employer

When there is a transfer of business, the new employer must recognise an employee’s service with the previous employer when calculating most entitlements, including:

- sick and carer’s leave,

- requests for flexible working arrangements,

- eligibility for parental leave.

Long Service Leave – in some cases, the new employer does not have to recognise service with the previous employer when calculating long service leave (see here for further information). However, in the vast majority of cases, the new employer will need to count service with the previous employer when calculating long service leave.

Unfair Dismissals – if the businesses are not associated entities, then the new employer can reset the minimum employment period for the purposes of employee eligibility for lodging unfair dismissal claims, under the Fair Work Act. See our article here about a recent case involving this.

This factor may possibly trigger a redundancy for the selling employer. As a result, it may be important for the outgoing employer to contractually require the new employer to recognise prior service of the employees, to avoid the possibility of becoming obliged to pay redundancy pay.

Agreement coverage – it is also important to note that if the transferring employee was covered by a registered agreement (e.g. an enterprise agreement), then they would remain covered by this agreement until the agreement is either terminated or replaced. Coverage of this agreement would only apply to the transferring employees, and existing and new employees of the new employer would be covered by the relevant industrial instrument applicable to the new employer (e.g. modern award or new employer’s enterprise agreement).

Service – if the transferring employee is later terminated by the new employer, only service with the new employer counts for determining their minimum notice period.

Need Assistance?

Transfer of business provisions can be quite complex, particularly in identifying your obligations to employees. Making mistakes when dealing with your employees can have massive financial impacts on your business and lead to potential litigation, so we recommend you seek our advice when buying or selling a business.

If you have any questions regarding the transfer of business, or if you are unsure of what to do, we encourage clients to call ER Strategies on 1300 55 66 37.

For those who aren’t clients, still give us a call to find out how we can assist you under one of our WorkShield service packages, or click the button below.