Due to huge media attention over the past 1-2 years, you will be aware of the variety of large-scale employers underpaying their staff. Woolworths, Coles, Bunnings, respected universities, and IBM have all been guilty of it and faced the consequences.

So why do these underpayment issues occur, from what should be considered highly moral, compliant organisations?

Common Causes of Underpayments

ERS has conducted around 1300-1500 audits over last 4 years across all different types of industries and businesses, and we have come across a wide range of issues. Across different sectors such as fast food, restaurants, financial services, and pharmacies, the most common issues to arise were:

- Incorrect base rates or classifications applied;

- Not paying allowances, or the appropriate penalty loading for the day of the week or time of day;

- Not performing right-to-work checks;

- Not observing minimum shift provisions;

- No written part time employee ‘change of hours’ agreements, meaning additional hours worked need to be paid at overtime rates.

Most employers that underpay their staff, do so unknowingly. They might equally be overpaying some people too, but that can be irrelevant in terms of audits by the Fair Work Ombudsman, or in the case of trial by media.

Woolies Underpaid Its Store Managers

In Woolworth’s case, they underpaid their employees by as much as $300 million, with total costs coming in closer to the $500 million mark when consultancy fees to calculate the underpayments are included, as well as accrued interest and unpaid taxes and superannuation.

ER Strategies completes hundreds of payroll audits each year, assisting many famous brand employers to ensure they are correctly meeting their payroll obligations.

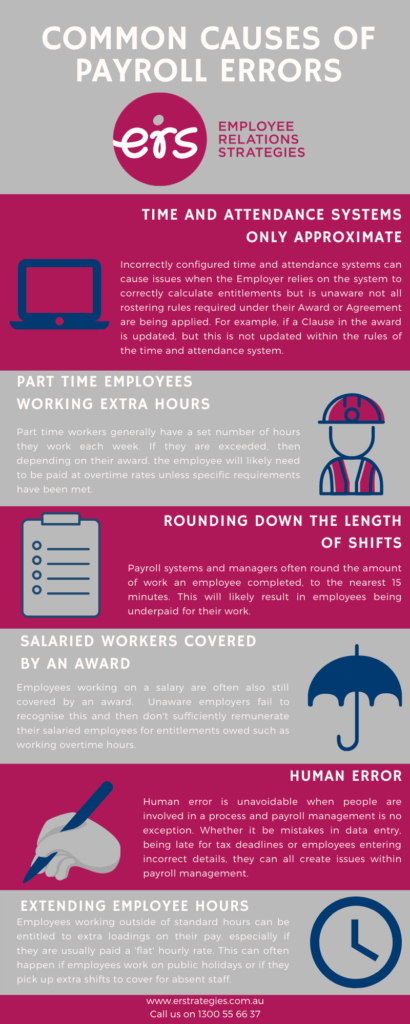

We have created the following infographic of 6 common reasons we have found why employees get underpaid. Click either here or on our infographic to access a full screen version.

Woolworth’s underpayments involved their store managers on salaries and only when a new enterprise agreement was being implemented that also covered store management, that it became obvious store management employees had been previously been underpaid against the applicable Retail Award conditions.

Other than the monetary loss, the underpayments no doubt also drastically impacted the way their employees affected viewed the organisation they work for, as well as the stain on their brand image and public perception.

The company’s governance report says that an externally-led review concluded that the underpayments were the “result of multiple points of failure across the organisation over a period of many years”. This statement summarises how a lack of an effective employment compliance framework with a focus on ensuring payroll accuracy, can lead to small issues in individual employees’ wages quickly turning into much larger ones for the whole organisation.

Want to read more on payroll compliance? Take a look at our Expert Guide to Payroll Compliance here.

System Issues

The issue we find when these situations arise, is quite often a systems problem. People in power in organisations assume that by using highly reputable Time and Attendance (T&A) systems which also interpret and apply the applicable award provisions, they are guaranteed to pay their employees correctly.

However, this is a dangerous mistake for businesses to make and has cost many organisations many millions, as we have seen in recent years.

Part of the problem lies with the fact that T&A systems, and the payroll systems they interact with, have to meet strict weekly or fortnightly deadlines to get people paid, whereas awards often have provisions which operate over a 2 or even 4 week period. So, T&A system rules that are written to try to take advantage of some of the award flexibilities over a pay period longer than a week, often trip up and underpay staff.

The system rules may handle 90% of required situations, but it is the 10% that they cannot which may require a manual process to be implemented or some other solution applied. Your payroll people attempt to faithfully carry out what they are instructed to do, but under the pressure of making the weekly or fortnightly payroll payments, don’t expect them to be thinking outside the box looking for other problems which might exist.

Here are some specific examples of underpayment causes that we have found from our own payroll auditing work for various clients:

Overtime Provisions

As indicated, award overtime provisions mean that once a certain number of hours have been worked in a 4 week period, then all additional hours need to be paid at overtime rates, but this isn’t picked up by the pay rules which just look at the week or fortnight being paid.

When you have a large payroll, a little bit here and there for one employee in a week can end up in a mammoth figure for the organisation over a period of years.

Public Holidays

Another issue is whether you need to pay an employee for a ‘public holiday not worked’ for those employees working different shifts on different days each week. The employee may be working on a recurring roster where they probably would have worked on a day had it not been a public holiday and are therefore entitled to payment for the holiday even though they didn’t work it.

However, for the T&A system, no hours were entered for the employee on the day, and therefore no payment was made.

Part Time Workers

Another emerging issue is award or enterprise agreement flexibility around part time work, where part time employees can choose to accept to work additional hours at ordinary time rates, if it falls within their nominated availability. The problem arises where the award requires that the additional hours be accepted in writing, but the time and attendance system has no way of recording that agreement. So, the hours then become overtime hours in the absence of evidence of a written agreement.

Extending Employee Hours

Employees working outside of standard hours can be entitled to extra loadings on their pay, especially if they are usually paid a flat hourly rate by their employer for simplicity purposes. There is nothing inherently wrong with paying a flat rate – as long as the employee never gets paid less than what they should have bene paid had their correct rate been applied.

However, issues arise when the employee works a different mix of hours to the basis on which their loaded rate was calculated. This can occur for a number or reasons, whether it be increased demand and longer opening hours, special circumstances such as a stocktake, employees filling in for other shifts they wouldn’t usually work, or working extra hours on public holidays or weekends.

Other Causes

There are a myriad of similar situations which can arise, and which result in underpayments and this is just one part of the many Employment Compliance challenges faced by employers, franchisors and their franchisees.

Getting our help

Worried you might have a payroll issue, but don’t know where to start? Click here to request a call or to find out more about how we can help you be confidently compliant.

If you have any questions or need help to ensure your compliance with award and industrial obligations we encourage you to call ER Strategies on 1300 55 66 37.